Market focus: January 2021

Market Drivers for Orange Juice Concentrate

Global Orange Juice production:

Global orange juice production for 2020/21 is forecast 17 percent higher to 1.8 million tons (65 degrees brix) as production in Brazil and Mexico more than offsets the drop in the United States. However, global production continues in a general long-term decline. Similarly, consumption is projected to continue its long-term decline, although exports are forecast up with the rebound from Mexico.

Americas:

Production is forecast down 16 percent to 250,000 tons with the drop in available oranges for processing in Florida. Consumption and stocks are expected to be down as a result of the lower production and despite higher imports

Europe Union:

Production is projected up slightly to 88,000 tons on an increase in oranges available for processing. Consumption is up slightly as higher production more than offsets lower imports. Brazil remains the top supplier to the EU.

Florida:

Current Orange fruit size is below average and is projected to be below average at harvest. Current dropage is is higher than expected and also above average at the time of harvest. This fruit drop is a major concern as the availabality for fruit for juice processing is less than favourable.

Mexico:

Production is projected to more than double to 200,000 tons on a rise in oranges available for processing after last year’s drought-decimated orange crop. Consumption and exports are expected to climb, keeping stocks unchanged.

Brazil:

The lack of rainfall and high temperatures during September-October 2020 prevented the first blossoming in ceveral citrus growing regions. It is expected to to reduce the full potential for the 2021/2022 citrus output. However, the second blossoming occured in October-November and benefited from the rainfall content anf moderate temperature. In terms of production, juice yields are down and due to US NFC juice increase the processors will run until the end of February in order to build up NFC supplies.

Europe:

EU orange juice production in 2020/21 (October 2020-September 2021) is forecast at 87 987 tones, a rise of almost 8% compared with the previous year. This forecast is in line with the expected growth in the volume of EU oranges destined for processing this season, particularly from Spain and Italy. Spain is the major orange processor in the EU followed by Italy. Approximately 20% of Spanish orange production is used for processing purposes. In 2020/21, EU orange juice consumption is forecast to grow slightly as a result of increased domestic supplies and growing consumer interest for immune- strengthening products following the Covid-19 crisis. EU imports of orange juice in 2020/21 are expected to ease to 681 000 tones from 686 223 tones the year before. The EU is a net importer of orange juice. However, during the last decade, EU imports of orange juice have declined by 17% due to the growth in domestic production and the downward trend of orange juice consumption. EU orange juice exports have reportedly increased by 45% over the past 10 years.

Pricing:

Brazilian FOB pricing – Ratios between 13-19, which are below the level they should be at this time of the year.

• Smaller processors FCA Europe $2,0800/MT 65Brix

• Larger processors FCA Europe $1,800-1,850/MT 65Brix

• Mexico pricing – offers on FJOC between $1,800-1,900/mt FOB Mexico Main Port

• Florida – $2,000/MT FOB Main Port

• EU average – Euro 1,320 – 1,450 /MT FOB

Apple Concentrate

Market Info on Global Apple Juice Conc

World apple production is expected to fall by 4%, or 3.3M MT during MY 2020/21 in comparison to the previous season. The fall in production is due to frosts and extremely cold weather during the flowering season in major apple-producing regions. Production for China, the world’s largest apple producer, is expected to fall by roughly 5% as severe frosts in Northern provinces of the country affected fruit production during the flowering period. Apple harvest on the West Coast of North America had already been affected by fires and labor shortages in the fall, and was aggravated by frosts in Michigan, another key-producing region. Overall production in the US is forecasted to decrease by 3% in 2020/21. Production in the EU, however, saw a slight upturn, set to increase by approximately 5% at 12.2 million MT in 2020/21, mostly due to the recovery of Polish apples that suffered severely from frosts and a lack of workers in 2019/20.

Europe:

This year’s apple crop is ranked moderately low in the decade ranking, about 4% below the 10-year average. This is partially because France, Spain, and Portugal had a bumper crop last year, which often leads to lower volumes the following season. During the growing season this year, there have been several weather events that could have impacted the crop. There was a very mild winter across Europe, but there were several frost episodes in late March and in April which had an impact on the apple crop. This summer, there were heatwaves and droughts in many regions, and this also had an effect on the crop. The European Union is working to move apple pickers to where they’re needed, all within the European Union, but there’s a lot of demand from Morocco and Ukraine for pickers.

China:

Apple crop was down 10-15% due to a series of freezes earlier in the year. Fruit prices are now trading at the top end of this range. Apple juice concentrates volume is down from last season and this has less to do with the weather and more to do with economic problems with the big producers.

Europe:

Poland:

Processing of the 2020/21 apple crop in Poland continues, there were less volumes produced than anticipated during the current crop. The industry in Poland was hoping to produce 250 000 tones of apple juice concentrate this season, but output is reportedly at 170 000 tones at the moment and so it is unlikely that production will reach 200 000 tones before processing winds up in the Spring.

Ukraine:

Production in the Ukraine has been lower than usual, but prices for high acid juice are currently stable. There is the sentiment that there is plenty of trading to come between now and the Spring in the Northern hemisphere – traders say that there are major buyers with open positions. For this reason, prices look stable and are unlikely to fall in the near term.

Turkey:

Over in Turkey, supplies are limited and offers for sweet apple concentrates are high.

USA:

Washington – Destructive wildfires and windstorms affecting the US and Canada are complicating the apple harvest on the West Coast. Washington is one of the most important apple producing states in the US, the second-largest apple exporting country. Apple suppliers were already experiencing disruptions with labor shortages and supply chain issues from the pandemic on top of retaliatory tariffs from China and India. Washington’s apple harvest is expected to be 10% smaller than the original estimate. This also leaves very little apples for processing int concentrate.

China:

Similar to Europe, the crop in China has now finished. There are reports that some processors have over-sold supplies and that Spring processing is not expected to make up for the short fall. There has also been strong demand from the fresh market which is also causing headaches for local processors.

Pricing: From top leading Countries

Poland

• High acid apple concentrate 70Brix 3% – Ex factory > Eur1250-1300/MT

• Medium acid apple concentrate 70Brix 2.5-3.0% – Ex factory Eur1200-1250/MT

Turkey

• Sweet apple concentrate 70Brix 1.0-1.5 % – CFR Europe Eur1150-1200/MT

Ukraine

• High acid apple concentrate 70Brix 3.0% – Ex factory $1200-1250/MT

USA

• Apple Concentrate 70Brix 1.0-3.5% – FOB $775-825/MT (Domestic Pricing not for export)

China

• Low Acid Apple concentrate 70Brix 1.5-2.0 – FOB China $1100-1150/MT

Grape Concentrate

Grape Juice Concentrate Market: Outlook

World production of grapes for 2020/21 is expected to be relatively unchanged at 25.7 million tones this year. Gains in China have offset the weather- induced losses in the European Union..

Argentina:

The 2021 grape crop in Argentina will begin in March. The vineyards were damaged by a freeze in October, but it still unclear how much the crop will be cut back as a result. Most buyers are covered until the new crop, but there has been some demand from buyers in Saudi Arabia, say producers. The industry will go into the new crop with limited carry over.

China:

China’s production is anticipated to jump 900,000 tons to 10.8 million as vineyards bounce back from last year’s severe frost. Rebounding supplies are expected to drive exports to a record 360,000 tons as higher shipments to the Philippines, Bangladesh, and Vietnam facilitate China’s continuing upward trend. Due to higher focus on export of fresh grapes this have left very little stock to Chinese grape processors for production. Chinese imports on Grape concentrate are estimated 27,000 tons lower to 235,000 due to reduced shipments from top suppliers Chile, Peru, and the United States. Small deliveries on Grape Concentrate from the European Union have commenced from Spain and Portugal; however, the United States currently remains China’s top Grape Concentrate Northern Hemisphere supplier.

Europe:

Production of Grape Concentrates are expected to decline 220,000 tons to 1.4 million mostly due to damaging rains during flowering in Italy – the top Member State. Exports are expected nearly unchanged at 75,000 tons. Despite lower supplies, imports on Grape Concentrates are estimated to slip slightly to 675,000 tons as reduced shipments from India, Peru, and Brazil more than offset gains from Egypt and Turkey. Reduced output is anticipated to drive consumption to its lowest level since 2001/02.

Chile – Season:

Production on Grape Concentrates are to be expected to remain steady at 840,000 tons though the industry has suffered a 24- percent decline over an 11-year drought. Growers have invested in various strategies to mitigate drought effects, including installing drip irrigation systems, planting drought-resistant varieties, and investing in private water reservoirs. In line with production, exports are anticipated to remain nearly unchanged at 645,000 tons on steady demand from the United States, China, and the European Union.

Spain – Season:

Grape crop in Spain is being harvested and volume is expected to be higher than last season. Demand for the Spanish

Grape Concentrates have been unusually high, driven by offered competitive prices.

Pricing: From top leading Countries

Argintina:

• Red Grape Conc (600) – FOB $1800/MT

• Grape white Conc 68B – FOB $1250-1350/MT

Spain:

• Red Grape Conc (600) – ex factory EURO 1480-1520/MT

• Grape white Conc 68B – FCA Europe Euro 900/MT

Banana Puree

Key Points: Banana Puree

Bananas rank as the 3rd leading crop in world agricultural production and trade. In response to fast population growth in producing countries as well as expanding global import demand, the crop with an approximate value of 31 billion USD. There are more than 1 000 varieties of bananas produced and consumed locally in the world, but the most commercialized is the Cavendish type banana, which accounts for around 47 percent of global production. Cavendish banana crops are able to achieve high yields per hectare and, due to their short stems, are less prone to damage from environmental influences such as storms. Cavendish banana plants are also known for recovering from natural disasters quickly. Approximately 50 billion tones of Cavendish bananas are produced globally every year. Virtually all Fresh and Puree Bananas supplied to the US and European markets are Cavendish, which are better suited to international trade than other varieties as they are more resilient to the effects of global travel. Cavendish are also the major type of bananas produced and consumed in China, and account for one-quarter of production and consumption of banana puree in Indi. Based on early 2020 figures, the global Banana Puree export industry generates around 12 billion USD per year. However, it is important to note that only around 15 percent of the total Global Banana Puree production is traded in the international market; the rest is consumed locally, most importantly in large producing countries such as India, China, and Brazil, and in some African countries where bananas contribute largely to people’s diets.

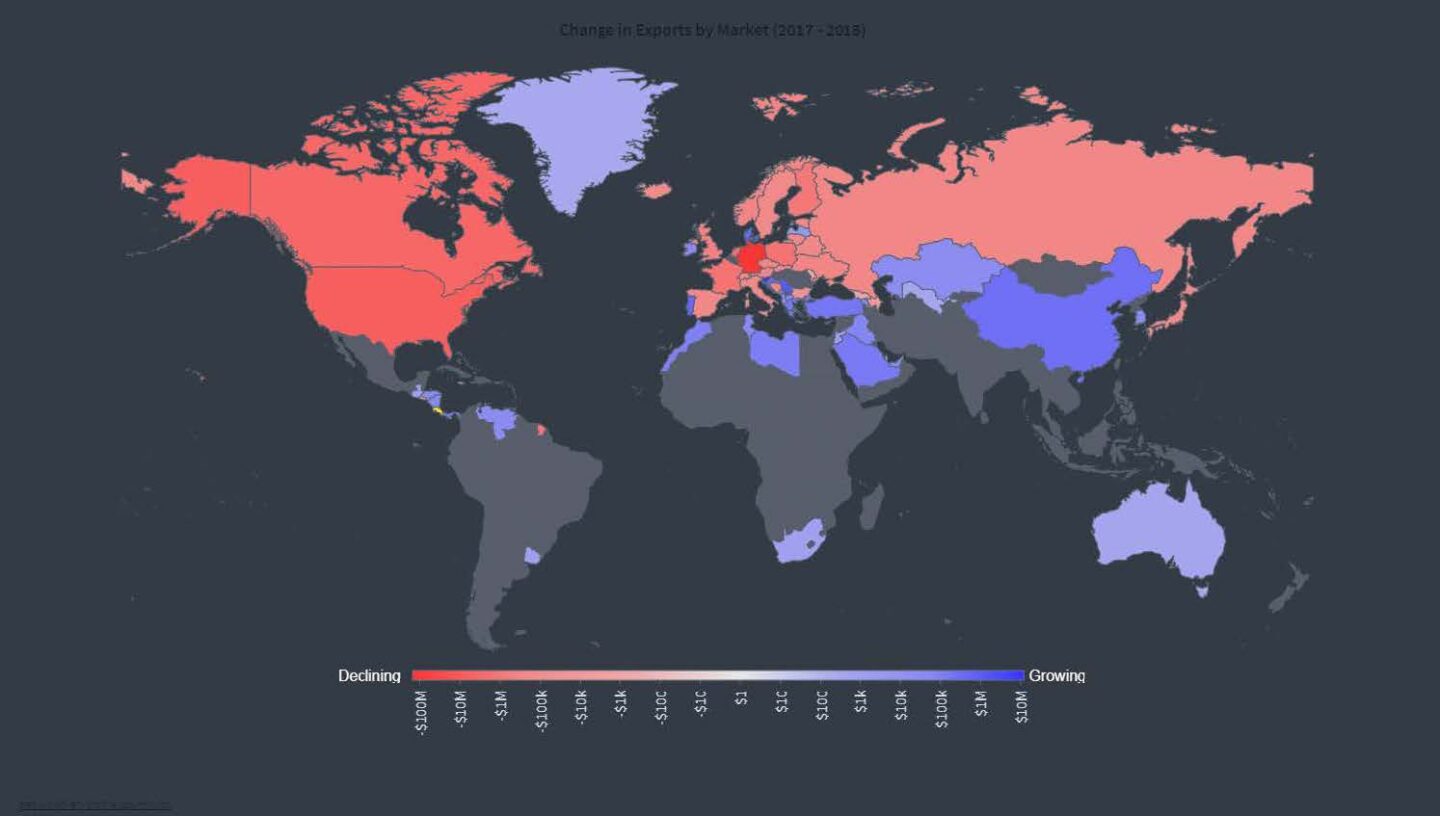

Which country has the biggest Fresh and Puree Banana industry in terms of GDP as well who is the biggest Fresh and Puree Banana exporters: The main exporter is Ecuador, which accounted for an annual average of one-third of total global Fresh and Puree Banana export volume. Other large exporters are the Philippines (13 percent volume share), Costa Rica (13 percent), Guatemala (12 percent) and Colombia (10 percent). The majority of exports from Central and South America are directed at the North American markets, Western Europe, Japan and Russian Federation.

Exports from Africa and the Caribbean are mainly traded in the European market and Exports from the Philippines in the Asian and Middle East Markets. The main exporters of organic Fresh and Puree Bananas are Colombia, Peru and the Dominican Republic.

Estimated figures on combined exports on Fresh and Puree Bananas

Ecuador:

Hurricane Eta occurred early November and impacted Ecuadorian banana production and prices. The strongest storm of this year caused torrential rain which resulted in floods and landslides. The storms damaged large banana plantations and severely impacted the production capacity of the country for the coming weeks. Due to the drastic loss in banana production and plantations, there was a shortage of Fresh and Puree Bananas available for exports in the export market. The lack of supply for exports was immediately reflected in the price of fruit available for processing. Manufacturers saw an increase of nearly 16% in Fruit for processing in just few weeks. The prices are expected to remain high for the next 4 – 6 months which is the minimum time estimated for the affected plantations to recover.

Costa Rica:

Fresh and Puree Banana activity is an economic and social engine for the country, it generates around 40,000 direct jobs and 100,000 indirect ones. Only in the province of Limón, 76% of the local workforce is generated. Costa Rica is one of the three most important Fresh and Puree Banana exporting countries in the world, generating about $ 1 billion in annual foreign exchange. The Costa Rican banana sector is recognized nationally and internationally for the great effort it has made to constantly investigate how to increase the productivity of banana farms and reduce the use of agrochemicals in plantations. This has lead to new market opportunities in the AMEA regions.

Columbia:

Colombia is the world’s fourth largest banana exporter (after Ecuador, Philippines, Guatemala and Costa Rica) and supplies about one tenth of the world export market, employing around 150,000 people Areas of Magdalena, La Guajira and Cesar produce 33.5% of the Fresh and Puree Banana that the country exports, their main destinations are the United States, Belgium, the United Kingdom, the Netherlands, Germany, France, and Switzerland, and South Korea. In addition, the region’s Banana Agro-Industry generates 12,134 direct jobs and 36,548 indirect jobs, which positions the sector as a key part of the national economy. Banana puree from Columbia is of excellent quality and is often used in the production of Baby Food Products.

Areas of Magdalena, La Guajira and Cesar produce 33.5% of the Fresh and Puree Banana that Columbia exports

Philippines:

The Philippines is one of the top five exporters of bananas, with some 2.85 million metric tones exported to the Asian and Middle East Markets. More than 80% of the bananas (and 99% of the Cavendish are being produced on the island of Mindanao, with Davao, Northern Mindanao and Soccskargen as the top regions and Davao del Norte, Compostela Valley and Bukidnon as the top three provinces. Cavendish bananas are grown in small to large commercial plantations for the domestic and export markets. Export In Fresh and Puree Bananas are produced by Filipino-owned firms and multinational corporations. The small- and medium-scale farmers producing bananas for export either sell to multinationals processors or directly to traders. A small portion of the country’s exports are organic bananas. Due to Epidemic, drought and Panama disease, the country is experiencing a drop in exports opening a gap for other Asian markets to fulfil ie Cambodia.

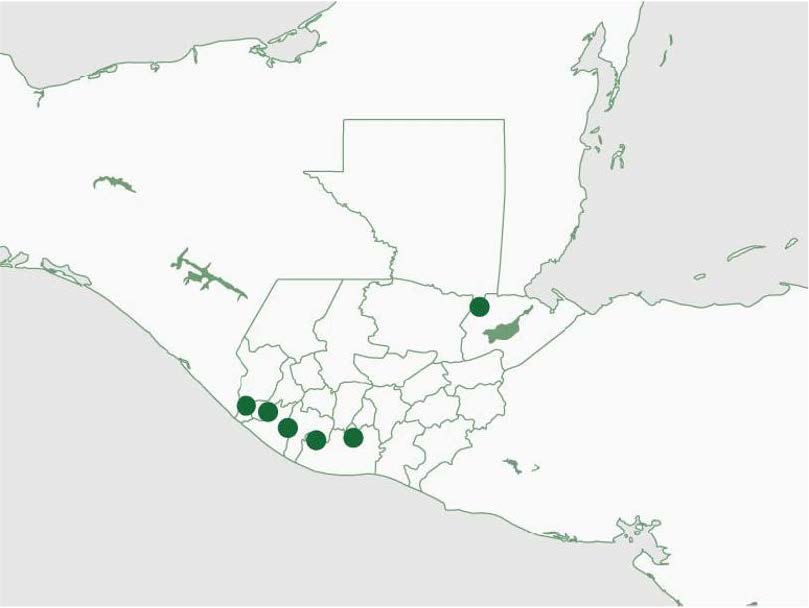

Guatemala:

With exports of more than 2.3 million tones, Guatemala is the world number three exporter on Fresh and Puree Banana, and one of the historic pillars of the world banana trade. The vitality of its production is remarkable, and unrivalled in the banana world. In the space of a decade, production has practically doubled: expanding surface areas, coupled with a highly intensive production system and excellent pedoclimatic conditions, have helped the Guatemalan banana industry to achieve one of the world’s highest productivities, with production costs defying any competition. After relentless growth, the planting dynamic seems to be starting to stabilize. Exclusively focused on the US market from the outset, Guatemala is now starting to seek alternative outlets, especially to the European market, though logistical constraints are still limiting its expansion.

Pricing: Indicative

India

Banana puree 21-23 Brix

• FOB $725/MTChina

Banana puree 21-23 Brix

• FOB $850/MT

Costa Rica

Banana puree 21-22 Brix

• FOB $550/MT

Ecuador

Banana puree 21-22 Brix

• FOB $600/MT

Philippines

Banana puree 21-22 Brix

• FOB $543/MT

Mango

Key Points: Mango – Totapuri, Alphonso and Kesar (India)

Indian processing sector:

The problems with container traffic have continued over the past month. There is congestion at transshipment points which has led to delays and there is a shortage of containers in India leading to a steep increase in freight costs. In addition, the implementation of the ‘New Farm Bill’ is expected to increase price realization for farmers and reduce prices paid by buyers. The commercial banks are reluctantly reducing interest rates for retail and corporate borrowers due to the slack market, say local sources in India.

Mango – AMP (India)

Unseasonal Rains and Cyclonic conditions delayed the Alphonso flowering by 1-2 weeks. Nevertheless the high rainfall has meant that growing conditions are favourable overall and production for the 2021 crop is predicted to be normal. Due to shortage fall of last year the demand is high especially from Europe.

Mango – TMP/TMC (India)

No damage was reported on the Totapuri crops, growing conditions are good and production for 2021 crop is predicted to be normal. Stock of 2020 is still available and expect to be depleted by end of March 2021, similar situation also occurs to the Totapuri Concentrate and is expected to be depleted by end of March 2021.

Americas:

Colombia is currently running fruit from the current Winter interim crop. The harvest began with a delay due to climatic factors, mainly ‘La Niña phenomenon’, which brings an increase in rainfall to The Americas. This led to below average volumes being delivered to the plants. Nevertheless, these problems have gradually eased and volumes are improving. The peak production period will be in mid-January 2021. All the supplies from the main crop in 2020 in Colombia have now been sold and shipped, but there should be some limited stocks available from mid-January 2021.

Pricing: From top leading Countries

India

• AMP – no stock available

• Kesar pricing at FOB $1450-1475/MT

• TMP pricing at FOB $875-900/MT

• TMC 28Brix pricing at FOB $1375-1425/MT – stocks should last until March 2021

Colombia

• Magdalena River 28 Brix FOB $1,150 -1,320/MT• Sing strength (puree) FOB 900-975/MT

Mexico

• Tommy Atkins Mango Conc (28Brix) FOB $1200/MT

Countries Manufacturing Passionfruit Concentrates

Price directions on the global market next year are difficult to determine mainly due to the uncertainty over demand. Uptake is reportedly healthy at the moment and prices seem relatively stable. Production in 2021 from the three main exporting countries (Ecuador, Peru and Vietnam) are expected to be similar to this year, or possibly slightly lower if Vietnam reduces their production. Ecuador and Peru are expected to finish this year with marginally lower stocks than in previous years.

Freight Issues:

Vietnams is also experiencing problems with ocean transportation and many shipping lines have announced a hike in the sea freight, cancellations and a shortage of containers. This would slow the shipments in December from Vietnam to major European seaports. European traders concur that freight prices from Vietnam, and across Asia a general, have climbed significant recently. This is attributed to:

• The pandemic – many people have switched from air freight to sea freight causing a lack of viable space on vessels

• Reported higher demand for shipping from the US

• Typical increased surcharges around Christmas

• A shortage of containers in Asia

Ecuador:

Ecuador was due to harvest its small interim Winter crop last month, but surprisingly it was the lowest production month of the year. Producers say the lower supply resulted in higher fruit prices, but so far this has not translated into higher prices for concentrate Local processors in Ecuador say that demand has been slow during the Christmas holidays, as it usually is, and so buyers would not have the appetite for higher pricing anyway, particularly given the lower pricing from other regions. The climate has been very dry recently and the majority of farmers in Ecuador depend on natural rainfall. The main crop areas are located in a region that usually have year-round rainfall during almost the entire year, especially between December and April, but December saw a significant lack of rains. Projections for output in Ecuador for 2021 are similar to volumes this year, but the climate could impact production in either direction.

Peru:

Peru remains in a low production period and most of the fruit produced stays in the domestic fresh market. Factories are currently delivering on older juice contracts. The country’s next peak production period will begin from mid-January. Peru is also expected to produce similar volumes in 2021 as last year.

Vietnam:

Vietnam, similar to last month. However, as mentioned last month freight prices are incredibly expensive. The availability of containers is limited and there is hardly any space available on vessels, say traders. While Ecuador and Peru are finishing the year with lower stocks than in previous years, Vietnam is reportedly starting the new year with significant stocks that will probably keep a lid on current market prices.

Pineapple JuiceConcentrate / Frozen Pineapple Juice

Key Points: Pineapple Juice Conc/Frozen Pineapple Juice

The big four pineapple producers in the world are Thailand, Philippines, Indonesia, and Costa Rica (85-90%). Thailand production is down to environmental issues. The Philippines production remains stable, while Costa Rica is producing more in NFC. Indonesia’s production keeps growing steadily but will not be able to substitute the shortfall of other countries.

Thailand Pineapple Conc/Juice:

Production from the current Winter crop in Thailand has been higher than expected over the past month and the quality of fruit has reportedly deteriorated. Output in Thailand for both the Summer and Winter crops in 2020/21 is now pegged at 0.8-1.0 million tones, against previous estimations of 0.8 million tones. This has meant that the factories have been less inclined to secure supplies of fruit which has resulted in a significant reduction in raw material pricing.

Central America Pineapple Conc/Juice:

Over 90 percent of Pineapple volume is produced in where Costa Rica (73 percent) is the main producer of Pineapple followed by Honduras (10 percent) and Mexico (9 percent). Supply of Pineapple fruit is low due to the early Covid -19 pandemic, supplies dropped to less than half of normal levels, which was also attributed to shipping problems in addition to supply chain issues, including lower market demand. However, even if there was a rise in January and February in price this year, the overall market price from Central America remains consistent. Costa Rica has increased their business in China, even if China produce their own pineapple their quality remains a problem. Therefore China prefer to import the Fruit, Juice and concentrate as consumers are looking for better quality for a healthier lifestyle.

Philippines Pineapple Conc/Juice:

The Philippines, particularly have embarked on a campaign to secure greater percentage of the global market and there is speculation that the producers will soon take the crown from Thailand as the key global pineapple producer. Difference between the 2 regions is the price of the fruit. The fragmented nature of Thailand’s Industry, with thousands of small farmers and fruit dealers, means fruit pricing is extremely volatile from year to year. In contrast, most of the processors in the Philippines own their own plantations and therefore can keep their pricing stable.

Pricing: From top leading Countries

Thailand

• Pineapple Concentrate – Remains between FOB $1750-1850/MT.

Central America – Costa Rica

• Pineapple Concentrate Frozen MD2 grade – FOB $2200 – 2300/MT

• Pineapple NFC – $750-800/MT CFR Europe

Philippines

• Pineapple Concentrate – FOB $1800-1850/MT

Prices from other Pineapple manufacturing areas:

• Brazil – Pineapple Conc 60B $2000/MT CFR Europe

• Kenya – Pineapple Conc 60B $2100/MT CFR Europe

Media Contacts:

Dana Füngers – Head of Marketing – Frutco AG – dana.fuengers@frutcoservices.net

Follow us on LinkedIn.